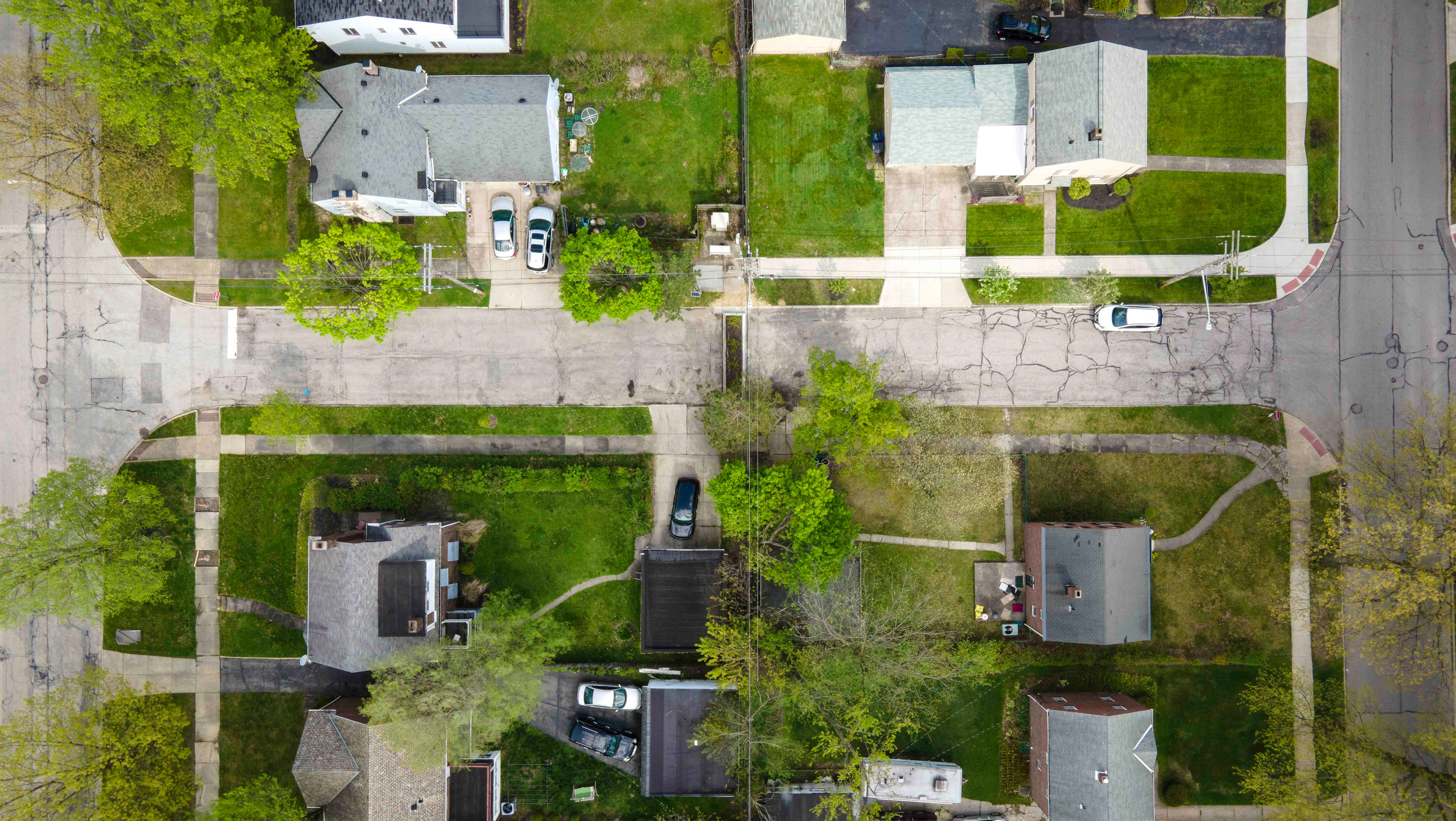

The docklands, home to many US multinational corporations. Irish incentives to base companies here, mainly due to complicated and highly extractive tax policies, have created what many label as a tax haven.

The Alliance is just one of many high-end apartment buildings created to cater to high-earning employees of the many "knowledge industry" corporations based in Dublin.

The docklands began as a SEZ (special economic zone) luring companies to regenerate Dublin with low base tax rates. It is anchored at the west end by the IFSC (International Financial Services Centre). It has since metastasized into an entire region of high-end apartments, corporate headquarters, banks, and civic institutions.

Office blocks dot the docklands area of Dublin. Many of them house corporate entities which have business descriptions that are laughably opaque.

For example: the block on the right is the headquarters of Suez Holdings, which lists on its website:

"Suez Holdings Ltd is part of a family of companies with a rich history, a solid presence and a bright future. Discipline, collaboration and a commitment to recognizing healthy growth, drive our work. Five fundamental values reflect our culture – performance, collaboration, innovation, social responsibility, and trust. I invite you to get to know us, do business with us, come to work with us and engage with us. We are proud of our decades of success and want to share our future successes with you."

Old and new in Dublin's docklands.

New construction in north docklands, Dublin.

Secondly, what is a “tax haven”? “A tax haven is a jurisdiction with very low "effective" rates of taxation for foreign investors”. Ireland claims that its corporate tax rate is 12.5%, although in practice companies, mostly from the US and UK, pay vastly less. Apple paid .005% tax rate on its profits from 2004-2014, shielding €110 billion in profits from tax authorities (they later were forced to pay restitution on the avoided profits).

Meta International HQ, Dublin.

IFSC (International Financial Services Centre), Dublin.

Google Campus, Dublin.

Renovation and gentrification in the heart of Dublin's financial services and tech district.